finanças

Tracking the evolution of Portugal mortgage rates

Let’s explore what mortgage rates are currently like in Portugal, how they’ve changed, and what to expect moving forward.

Are you planning to buy a home or refinance your mortgage in Portugal? The interest rates you choose can make all the difference to your financial future. Let’s dive into the current mortgage rates and how they’ve evolved recently.

Current mortgage interest rates in Portugal

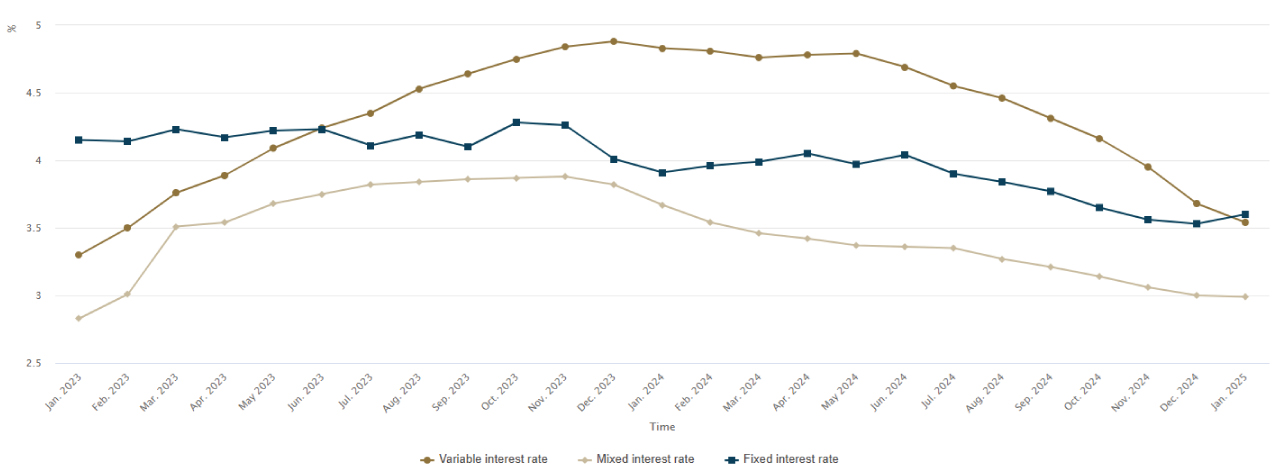

Currently, mortgage interest rates in Portugal have stabilized after a period of significant fluctuations. This stability is reflected in the range of rates available to borrowers, with fixed rates ranging from 2.50% to 3.80%, variable rates between 2.30% and 3.20%, and mixed rates ranging from 2.70% to 3.50%, depending on the loan term and the type of contract. Each option has its characteristics and is suited to different financial profiles.

According to the Bank of Portugal, there has been a notable shift in the types of rates people choose. A significant 70% of new mortgages are now being taken with a mixed rate, indicating a clear preference among borrowers. This type of mortgage, which involves an initial period with a fixed rate followed by a variable rate, has become increasingly popular due to its flexibility in uncertain economic times.

Variable-rate mortgages now account for 23% of new contracts, a recovery from a historical low of 15%. This recovery is a positive sign for the market and should make potential homebuyers feel optimistic about the current conditions. Meanwhile, fixed-rate mortgages continue representing a smaller portion of the market, making up 6% of new contracts.

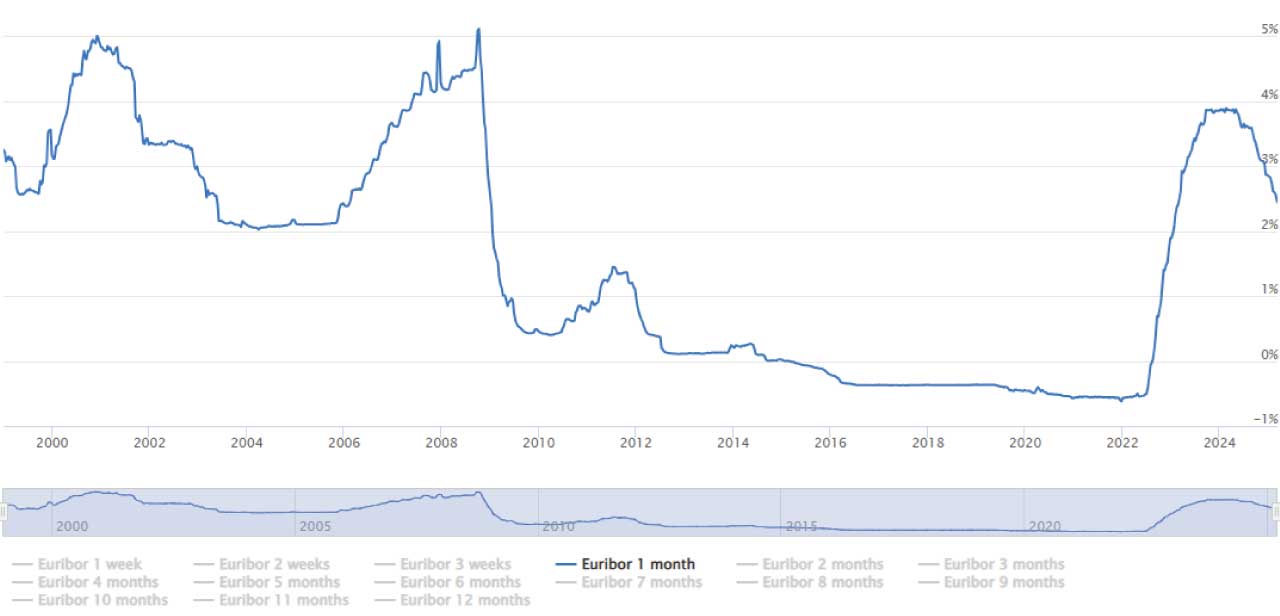

Variable interest rates

Variable rates are often linked to the Euribor, which can fluctuate over time and has recently decreased. Euribor (Euro Interbank Offered Rate) is the interest rate European banks lend each other. This rate is important because all mortgage contracts in Portugal are tied to it. When the Euribor rises, so do mortgage rates; when it falls, mortgage rates typically decrease as well.

According to the Bank of Portugal, the average interest rate for new home loans has stabilized at 3.22%, following 14 consecutive months of decline. This reflects a period of stabilization after a series of increases driven by Euribor and the monetary policy of the European Central Bank (ECB).

Mixed interest rates

Mixed rates combine an initial period with a fixed rate, followed by a period when the rate becomes variable, adjusted based on the Euribor. This option has gained popularity, especially among borrowers who want more predictability during the loan's early years but also want the flexibility to adjust the rate later, depending on market conditions.

As of now, the Euribor stands at 2.39%. Additionally, the average for March is 2.37%, and the current year’s average is 2.52%.

Fixed interest rates

Fixed rates for home loans in Portugal vary depending on the loan term. Generally, these rates are higher for longer loan terms, but they offer the advantage of stability, ensuring that the amount of the monthly payments will not change throughout the agreed period.

Evolution of mortgage rates

Between 2020 and 2022, mortgage rates in Portugal were at historically low levels, often below 1%. However, starting in 2022, rates began to rise as the ECB implemented a series of interest rate hikes to curb inflation. This increase directly impacted variable-rate mortgages that are tied to the Euribor, which started rising after years of being negative, making mortgages more expensive for homeowners.

The peak of interest rates occurred in 2023 when the average mortgage rate for new loans hit 4.65%. Since then, rates have started to decline, and by January 2025, the average rate has settled at 3.22%, reflecting the ECB’s policy changes and the stabilization of the market.

The evolution of mortgage rates has mirrored the changes in the Euribor rate and the broader economic conditions in the Eurozone, showing how closely these factors are intertwined with local lending conditions.

Future perspectives

Forecast for 2025

Looking ahead, mortgage rates in Portugal are expected to continue their gradual decline throughout 2025. As the European Central Bank (ECB) works to lower interest rates in response to a cooling economy, the Euribor rate is likely to follow suit, reducing borrowing costs for homeowners.

In March 2025, the ECB announced a 25 basis point cut in its key interest rates, bringing the deposit facility rate to 2.50%, the main refinancing operations rate to 2.65%, and the marginal lending facility rate to 2.90%. As a result, mortgage rates in Portugal, particularly for variable-rate mortgages, are expected to continue decreasing.

The economic environment in Portugal is also expected to benefit from these financial conditions, with the country's GDP projected to grow by 2.3% in 2025. This growth will be driven by a combination of external demand acceleration and the continued use of European recovery funds, particularly from the Recovery and Resilience Plan (PRR), which will peak in 2026. These factors should help stabilize the overall economic conditions, contributing to lower inflation and reduced borrowing costs.

By mid-2025, the 6-month Euribor could drop to around 2.5%, with further decreases expected by the end of the year. The 3-month Euribor is forecasted to average around 2.40% by the end of 2025, ranging between 2.30% and 2.50%. Similarly, the 12-month Euribor is expected to gradually decline, with projections placing it between 2.30% and 2.50% by the year's end.

These trends should lead to lower mortgage rates, particularly for those with variable-rate mortgages. As a result, borrowers in Portugal could see a reduction in their monthly payments, especially for those with loans tied to the Euribor.

To better understand how interest rates might impact your payments, try using a mortgage calculator to see the best option for your financial profile.

Forecast for 2026 and beyond

Looking further ahead, mortgage rates in Portugal are expected to continue their gradual decline into 2026, although at a slower pace compared to the previous years. By 2026, the Euribor is anticipated to remain relatively low, with projections suggesting that the 3-month Euribor could range between 1.39% and 1.66% throughout the year. This would reflect a continued reduction in borrowing costs for homeowners, especially for those with variable-rate mortgages.

The 6-month Euribor and 12-month Euribor are also expected to stay low, with estimates placing them between 1.90% and 2.14% in early 2026. These rates should lead to more favorable conditions for borrowers, especially if the economic situation remains stable and inflation continues to be controlled.

Despite these optimistic projections, it is important to keep in mind that global economic factors, political uncertainties, and potential changes in the European Central Bank (ECB) monetary policies could alter these expectations. The ongoing recovery in Portugal’s economy, combined with the use of European funds, will likely support the continued decline in mortgage rates, but unforeseen circumstances could influence this trajectory.

While the long-term outlook remains positive, these projections are subject to change, and borrowers should always stay informed about market conditions and consult financial advisors for the most up-to-date information.

Please note that these are projections based on current economic conditions and trends. As such, they are subject to change based on unforeseen economic developments, policy adjustments, and other external factors. Always consult a financial advisor for the most up-to-date information.

Mortgage rates comparison with EU countries

When comparing mortgage rates in Portugal with those in other EU countries, it’s important to note that Portugal’s rates have traditionally been higher than the European average. However, this gap has narrowed in recent years, especially as ECB rate cuts take effect.

For example, in January 2025, the average mortgage rate in Portugal stood at 3.22%, compared to the Eurozone average of 3.14%. The difference is more significant for smaller loans, with Portugal having slightly higher rates for loans under 1 million euros. For larger loans, rates in Portugal align more closely with the European average.

The Bank of Portugal has worked to reduce these disparities, but factors such as bank spreads and local market conditions continue to influence these differences.

The information provided isn’t a substitute for consulting public or private experts in each area.