finanças

Step-by-step guide on how to use a mortgage calculator

Are you dreaming of buying a home in Portugal? Before you take the leap, understanding how your mortgage is calculated can save you from costly surprises and help you plan with confidence.

Whether for investment, relocation, or a holiday retreat, buying property in Portugal involves big financial decisions—starting with your mortgage. Using a mortgage calculator to understand how your loan is calculated helps you plan ahead, avoid unexpected costs, and choose the best financing option for your needs.

Mortgage vs. home loan: what’s the difference?

Let’s put it in simple terms - if you’re researching mortgages in Portugal, you’ll come across the term "crédito habitação" instead. But is it the same thing? Pretty much.

A crédito habitação works just like a mortgage. The bank lends you money to buy a property, and that property itself serves as collateral. This is secured through a hipoteca (mortgage lien), which means the bank holds a claim on the home until the loan is fully repaid.

So, when you use a mortgage calculator, you’re actually calculating your crédito habitação - your monthly payments, interest rates, and loan terms. Now that this is clear, let’s dive into the numbers.

Key factors to consider in a mortgage calculator

Understanding how your mortgage is calculated helps you plan your finances and avoid surprises. Below are the key elements determining your loan amount, monthly payments, and total interest costs.

Property price

The property’s total purchase price impacts your loan amount, taxes, and additional costs. Banks determine how much they are willing to finance based on this value, but they also consider the appraised value. If the appraisal is lower than the purchase price, the loan will be based on the lower value.

Loan amount and LTV

The Loan amount is how much you borrow from the bank after making a down payment. This is influenced by the Loan-to-value (LTV) ratio, which determines what percentage of the property's value the bank will finance.

Banks tend to apply more conservative lending policies to foreign non-residents, often offering LTV ratios between 65% and 75%.

Keep in mind that banks always base financing on the lower value between the purchase price and the property's appraised value.

Interest rate

Your mortgage interest rate determines how much you pay in borrowing costs. Banks offer two types of interest rates:

- Fixed-rate: stays the same for the entire loan term or a specific period (e.g., 10 years)

- Variable-rate: based on the Euribor + bank spread, meaning your payments fluctuate as interest rates change.

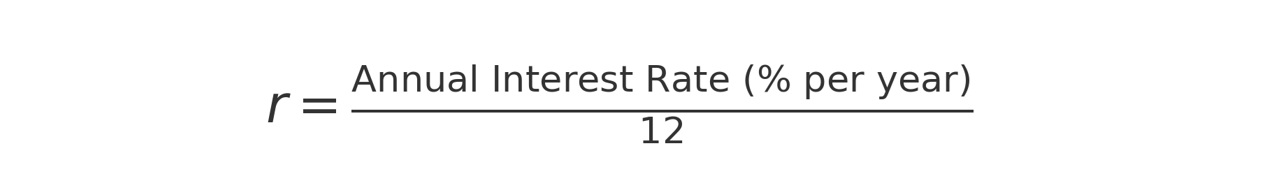

To calculate your mortgage, you need the monthly interest rate (r):

Loan term

The term is how long you have to repay the loan. In Portugal, mortgage terms range from 5 to 40 years, depending on your age and bank policies.

- Shorter terms (5-20 years): higher monthly payments, less interest paid

- Standard terms (25-30 years): a balance between payment size and total interest

- Extended terms (35-40 years): available for borrowers under 30 years old, resulting in lower payments but higher total interest.

Since minimum and maximum loan terms vary by bank, it’s always best to check directly with your chosen lender to confirm the available options.

Total interest paid over time

To understand the full cost of your mortgage, calculate the total interest paid

Total Interest = (M x n) − P

This shows how much extra you’re paying beyond the borrowed amount.

Amortization schedule

Mortgages follow an amortization structure where you pay more interest in the early years and more principal later on. Over time, your payments shift from covering mainly interest to reducing your loan balance.

A breakdown of principal vs. interest payments can help you see how your mortgage progresses.

Additional costs that affect your mortgage

Your mortgage isn’t just about the loan amount. There are extra costs to consider, such as:

- IMT (Property Transfer Tax): a tax based on property value

- Stamp duty: usually 0.8% of the purchase price

- Bank fees: property valuation, application fees, early repayment penalties

- Insurance: life insurance and home insurance are often required.

These costs should be factored into your overall budget. By doing so, you can avoid unexpected expenses and feel prepared for any additional costs that may arise during the mortgage process.

Step-by-step manual calculation

Here's how you can manually calculate your monthly mortgage payment:

Formulas

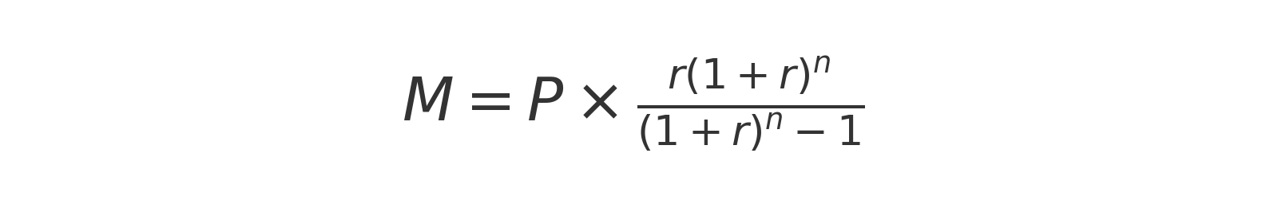

The standard formula for calculating the monthly payment (M) on a fixed-rate mortgage is:

Where:

- M = Monthly payment

- P = Principal loan amount (the amount borrowed)

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Total number of payments (loan term in months).

Practical example

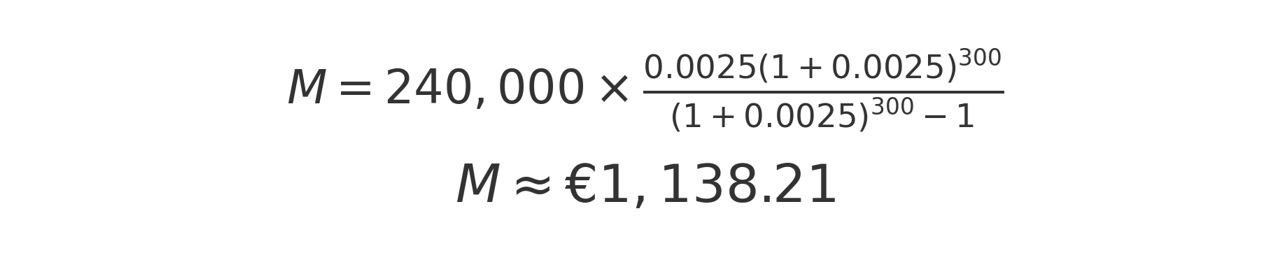

Let's consider a practical example:

- Property price: €300,000

- Down payment: 20% (€60,000)

- Loan amount (P): €240,000

- Annual interest rate: 3%

- Loan term: 25 years (300 months).

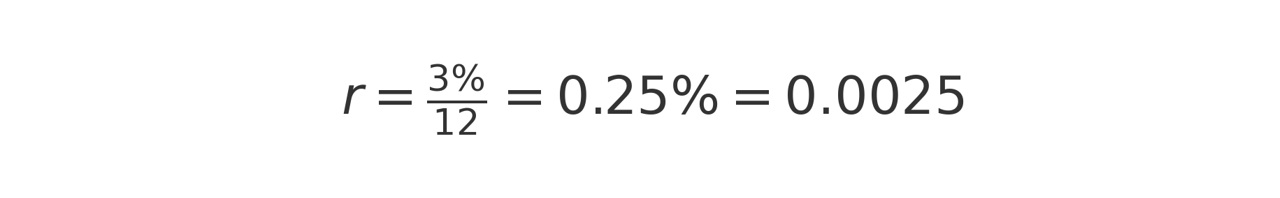

1. Convert annual interest rate to monthly:

2. Calculate monthly payment:

So, the monthly payment would be approximately €1,138.21.

Using the Santander mortgage simulator in Portugal

For a more intuitive approach, Santander Portugal offers an online mortgage simulator that allows you to input several parameters and instantly see your estimated monthly payments.

How to use the simulator

1. Visit Santander Portugal's mortgage calculator page

2. Choose the purpose of the mortgage (buying a home, transferring a mortgage, or using another property as collateral)

3. Select if It’s a primary or secondary residence

4. Choose the simulation type (calculate monthly payment or loan amount)

5. Enter the desired monthly payment or loan amount

6. Specify the property’s location

7. Indicate the number of borrowers

8. Select the interest rate type and view the results.

This tool is handy for testing different scenarios and understanding how loan terms or interest rate changes affect your payments.

The information provided isn’t a substitute for consulting public or private experts in each area.